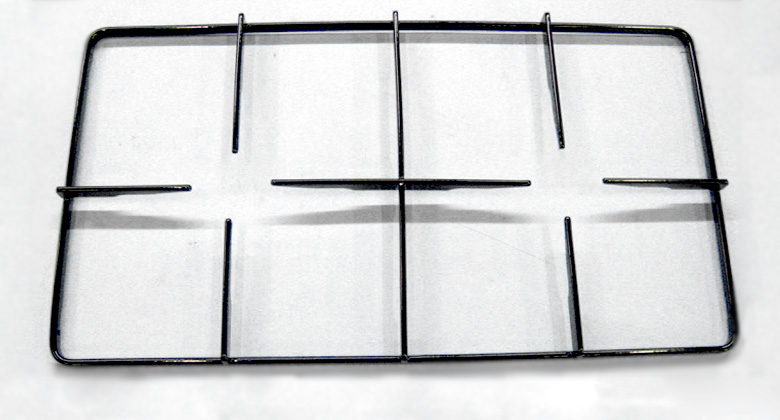

Subsection of cast -iron grilles for gas plates

The stable demand for cast -iron lattices significantly forms primary demand, that is, purchasing by manufacturers of gas stoves.

Therefore, to study this subsection, we propose to study the purchases of Russian and Belarusian manufacturers of gas slabs (Gorenje, Ales, BrestgasoApparate - Hephaestus, Gazmash, Kanevsky Gas Factory, Comfort, Lada, Lysva, Dream, Kinovok, Oka, Omochka, Elta, etc. - In total about 15 enterprises).

Key questions:

- Source of receipt of grilles (own production or external equipment)

- The volume of purchases

- The degree of interest in the sentence from the new supplier of cast -iron casting.

Subsection of dishes from cast iron

Preliminary content of the report

1. Evaluation and analysis of the conjuncture of the supply of foreign manufacturers of cast iron

1.1. Dynamics of supplies to the Russian market for dishes from cast iron in natural and monetary terms of 2012-2014.

1.2. The structure of the supply of cast iron dishes in the context of manufacturers (Kelli, Regent, Sirman, Staub, Vitesse, etc.)

1.3. Assortment of delivered dishes from cast iron of the main manufacturers (pans, weighting agents, etc.)

1.4. Prices for products of the main foreign manufacturers

1.5. Distribution channels of the main foreign manufacturers

2. Evaluation and analysis of the conjuncture of the offer of Russian manufacturers of dishes from cast iron

2.1. Identification of Russian manufacturers of cast iron dishes (Berlik, Biol, Dolyana, Siton, etc.)

2.2. Study of Russian manufacturers of cast iron dishes:

- location, entering holding

- financial indicators (revenue, profit, profitability) over the past 3 years

- Assortment of manufactured products from cast iron, c.

- the volume of production of dishes from cast iron in natural terms

- Distribution channels of cast iron dishes

- Dynamics of production of dishes from cast iron over the past 3 years

- plans to increase the volume of production of dishes from cast iron and changes in the assortment

- assessment of the potential of import substitution of dishes from cast iron

2.3. Identification and study of investment projects on the organization of production of products from cast iron (project parameters, scale, initiator, implementation time, etc.)

3. Analysis of the Russian market of cast iron dishes

3.1. Assessment of the total volume of the Russian market of dishes from cast iron in natural and monetary terms

3.2. The dynamics of the Russian market of cast iron dishes in natural and monetary terms

3.3. The ratio of Russian and foreign products in the Russian market in 2012-2014.

3.4. Comparison of the main manufacturers present in the Russian market (assortment, prices, location, distribution)

3.5. Trends in the change in demand for dishes from cast iron, including Compared to dishes from other materials (aluminum, ceramics, etc.) in the most significant consuming regions

3.6. Readiness and working conditions with a new manufacturer of dishes from cast iron

3.7. The current situation and the development forecast of the Russian market of cast iron dishes

3.8. Barriers and risks of organizing production of dishes from cast iron