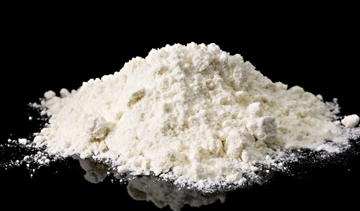

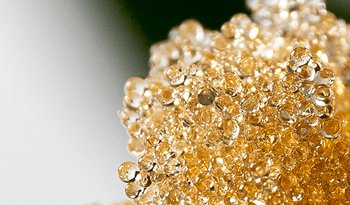

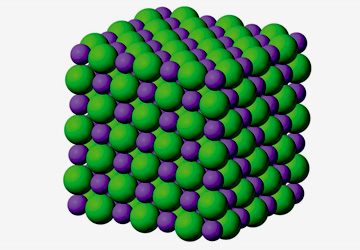

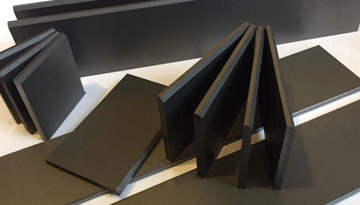

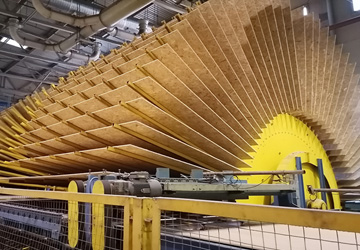

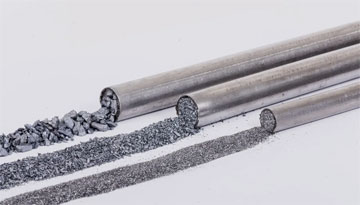

The product is a lump material or fractionated powder obtained by firing aluminosilicate raw materials - refractory clay, kaolin, clay, bauxite, dysten -syllimanite, kianite, underwin, and depending on the type of raw materials, the material of various mineralogical composition is obtained (the content of Al2O3 from 39 to 90% is obtained from 39 to 90% ), which determines the chemical resistance, area and temperature of the application of materials made on its basis.

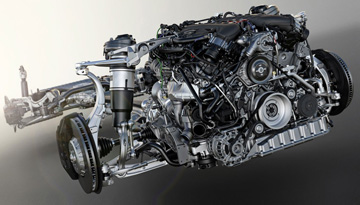

The product is used mainly as a filler in the production of molded and unformed refractory materials and products, as well as building materials, ceramics, casting molding mixtures, abrasives, mineral filler of various composite materials, etc.

1) The product is a lump (chamotnaya, mull -aemic -core = mullite, mullycorundal)

2) the product is fractionated (chamotnaya, mull -aemic core = mullite, mullycorundal)

3. The objectives of the study:

• Assessment of capacity, balance of production and consumption of product in the markets of Europe and Russia.

• Identification of food products (technical names, brands, brands) and their segmentation

• Identification of potential consumers of the product in the market of Europe and Russia

• Identification of the most promising segments of the product market

• Analysis of the current prices and their dynamics

• Forecast of the development of consuming (influencing) industries and the product market for the medium term

5. Target objects of research

Participants in the Russian and European market-manufacturers (competitors), consumers, participants in import operations, traders, trade and production companies performing integrated work (design, supply of materials, lining installation)

6.1. Russian market

6.1.1 Identification of the features of the use of the product, alternative commodity items, requirements for characteristics depending on the consumption industry

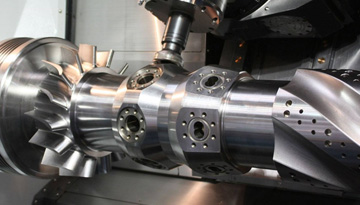

6.1.2. Assessment of a competitive environment and connections supplier-consumer, supplier-trader-consumer. Characterization of the main (large) manufacturers in format:

- coordinates and brief description

- supply volumes in the context of consumers

- plans for modernization and increase/decrease in production, trends

6.1.3. Identification of prices for the product depending on the supplier, the content of AL2O3, fractional composition, the type of consumers

6.1.4. Assessment of demand for product. A brief characteristic of consumers. Identification of consumer preferences and possible conditions for the change of supplier. The formation of a relevant database of potential consumers of the product (20 enterprises), including:

- dynamics of the volume of production of targeted products

- brand and volume of consumption (evaluative)

- The main supplier is currently

- satisfaction with high -quality and price indicators

- existing problems

- Criteria for choosing a supplier,

- readiness and conditions of cooperation with the new supplier

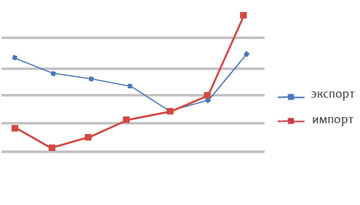

6.1.5. Import/Export analysis

- dynamics, average prices, importers/exporters

- trends and features of import and export supplies (options for the name of the products and codes of HDEA to minimize customs payments)

6.1.6. RF market capacity assessment

6.2.1 Identification of products and brands (commodity names, brands) other than traditional chamotte (including calcified kaolin-29-44% AL2O3, calcified boxing-up to 88% AL2O3, so on as well as the product use of the product, the features of the use of the product, quality requirements, etc. As it is detected

6.2.2. Assessment of a competitive environment is the identification of large European product manufacturers. Characterization of manufacturers in format:

- production volumes depending on the qualitative characteristics

6.2.3. Identification of the price level and/ or pricing principles for the product or related products (if possible/ assessment). The assessment methodology is determined as the market characteristics are detected.

6.2.4. Assessment of the capacity of the product market in Europe. Note: The market capacity is determined by evaluations on the Commodity products that can be identified by the Codes of HDDs and the reporting of market participants. The assessment methodology is determined in the process of research as the features of the European market are identified.

- capacity of the market of the Russian Federation and Europe in monetary and natural terms

- Analysis of the situation and market prospects,

- conclusions and recommendations