Part 1. Technical market analysis

1.1. The world market of "smart" systems for processing and analyzing video images

1.1.1. Goals, objectives, conceptual system of the system:

- Computer Vision;

- Machine Vision;

- Video Processing;

1.1.2. Areas and segmentation, promising areas of application, necessary conditions for access to promising markets;

1.1.3. The effect of the introduction of such systems;

1.1.4. Examples of specific solutions with price / equipment / description;

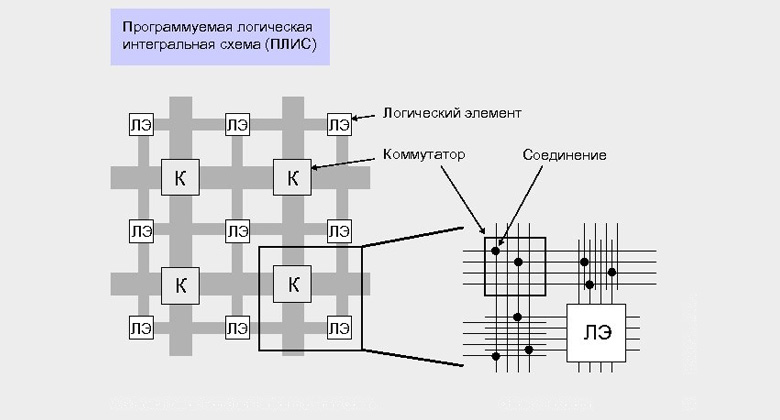

1.1.5. Technological requirements for such systems and their components in the form of a review of the technologies used in them (including the design norms of the chips, the type of chips, the capacity of the channel, computing power and the volume of the "iron" of the server part). Technological map of development from the point of view of design norms;

1.1.6. The role of software;

1.1.7. Technological and other barriers of market development. Forecast for the development of technologies in the field of video processing, life lifespan;

1.1.8. Market development drivers;

1.1.9. Assessment of the market volume of "smart" video processing systems in the context of products, geographical sales markets, use. Market forecast 2009 -2015, market data over the past 3 years: 2005-2008;

1.1.10. Barriers / motivation for entering the market, key competition factors;

1.1.11. The main players in the market for video processing systems. Technologies, products, plans for the development of technology with binding.

Part 2. Analysis of the market of consumer products (taking into account "smart" products):

2.1. World market IP camera and video surveillance

2.1.1. Product description, functionality. Description of solutions and systems based on this product. Description of the areas of application of product / solutions / systems;

2.1.2. Market data over the past 3 years (2005-2008). Market forecast 2009-2015

2.1.3. Geographical market segmentation. USA, Israel, EU, South Korea, Japan, China, Russia. Consumption, production (including in the context of areas of application, technological design standards);

2.1.4. Market segmentation by areas of use. Analysis of the areas of use of IP cameras. Analysis of consumer needs;

2.1.5. IP cameras / systems market drivers / solutions in each segment;

2.1.6. Barriers / motivation for entering the market, key competition factors;

2.1.7. The main manufacturers of the IP camera. Production volumes, revenue, EBITDA, market share. Plans for the implementation of new technologies. Analysis of sales strategy / sales chains in the industry;

2.1.8. Analysis of the market for components for IP cameras. SBIS. Image processing controller module. Market forecast 2009-2015 The main suppliers in the market;

2.1.9. Analysis of the chain of creation of value to the final consumer. The allocation of market participants for redistribution.

2.2.1. Product description, functionality. Description of areas of application;

2.2.2. Market data over the past 3 years (2005-2008). Market forecast 2009-2015;

2.2.3. Geographical market segmentation. USA, Israel, EU, South Korea, Japan, China, Russia. Consumption, production (including in the context of areas of application, technological design standards);

2.2.4. Market segmentation by areas of use. Analysis of the areas of use of Web cameras. Analysis of consumer needs;

2.2.5. Web-camera market drivers in each segment;

2.2.6. Barriers / motivation for entering the market, key competition factors;

2.2.7. The main manufacturers of Web cameras. Production volumes, revenue, EBITDA, market share. Plans for the implementation of new technologies;

2.2.8. Analysis of the market for components for Web cameras. SBIS. Image processing controller module. Market forecast 2009-2015, main suppliers in the market;

2.2.9. Analysis of sales strategy / sales chains in the industry, the main participants in the market for redistribution.

2.3.1. Description of products, functionality and consumer requirements.

2.3.2. A review of technologies (including from the point of view of design norms) and products in the field of communication processors and digital special communications.

2.3.3. The volume of the market of special communications in the context of products. Market forecast 2009 -2015

2.3.4. Analysis of the market of communication processors.

2.3.5. Market development drivers. Forecast for the development of digital special communications technologies, life lifespan

2.3.6. Barriers for entering the market, including from the part of Gos. Organ, key factors of competition. The allocation of markets that can be penetrated.

2.3.7. The main players in the field of digital special communications. Technologies, products, technology development plans.

2.4.1. Description, functionality, purpose and consumer requirements;

2.4.2. Technical requirements for "iron";

2.4.3. Copyright and compatibility protection issues;

2.4.4. Approximate cost cost;

2.4.5. Analysis of the market for developers. Market volume, market forecast, development prospects.

Part 3. Analysis of the business model / strategy:

3.1. Technological development strategies of 5 largest and 5 fastest growing (revenue of at least $ 100 million) Fables companies:

3.1.1. History of creation, key facts of development;

3.1.2. Review of products with reference to the final use. Product line in the context of technological design standards;

3.1.3. Plans for the development and implementation of new technologies and products. Plans for transitions to new design norms;

3.1.4. Investment plans. The volume of investments, the direction of investment, the source of investment.

3.2.1. Description of a business model of creating a product including interaction with contractors, customers, performers, software companies, etc.

3.2.2. The conditions for interaction with contractors, customers, performers, software companies, etc.

3.2.3. Strategies for promoting and selling products;

3.2.4. A chain of cost creation. SBIS-controller- software;

3.2.5. Review of M&A transactions among Fables companies.

4.1. Description of project products (composition, device, nomenclature), scope.

4.2. Analysis of project products, including competitive advantages in comparison with analogues:

4.2.1. IP cameras. SBIS, module controllers of image processing, camera;

4.2.2. Web cameras. SBIS, module controllers of image processing, camera;

4.2.3. Special communications. SBIS, mobile terminal of digital special communications;

4.2.4. Systems / solutions based on them.

4.3. Analysis of the strategy of promotion and channels of project sales in the markets of Russia, USA, Israel, EU, Asia -Pacific region:

4.3.1. IP cameras. SBIS, module controllers of image processing, camera;

4.3.2. Web cameras. SBIS, module controllers of image processing, camera;

4.3.3. Special communications. SBIS, mobile terminal of digital special communications;

4.3.4. Systems / solutions based on them.

4.4. Analysis of the chain of creating cost for each product. IP cameras, Web camera, special communications terminal. SBIS-controller-sketch.

4.5. Analysis of the cost of development of SBS.

4.6. Description of the main consumers, regional segmentation.

4.7. Analysis of interaction with performers, contractors, customers and suppliers.

4.8. Project implementation site.

4.9. Competitive advantages of the project. SWOT analysis of the project.

4.10. Project risks analysis.