I. Muravic acid market

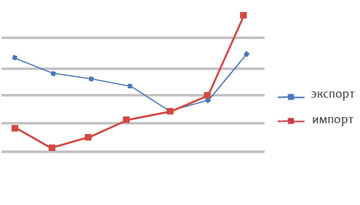

1. Analysis of the anti-acid market in Russia in 2011-2018.

1.1. Analysis of export-import supplies of anticoic acid according to manufacturers, suppliers, at a price) to Russia in 2011-2018. Antic acid market capacity (in tons and in rubles). The main importers and their shares (import development plans). The main world manufacturers (production volume, year of launch of installation, planned dates of modernization/overhaul);

1.2. The main trends and forecast of market development (optimistic,

Pessimistic, basic) anticolor acid in Russia until 2025

2. Analysis of consumption and demand for anticated acid in 2017-2018. Demand forecast until 2025

2.1. Demand for ants in 2017-2018 The current and forecast consumption of ants in consumption and the largest consumers until 2025:

- manufacturers of feed / feed additives;

- manufacturers of reagents for skin dressing;

- Manufacturers of anti -icing reagents

- Other consumers

2.2. Factors for making consumer decision on the purchase of anticolic acid (price, technical characteristics, regularity of supply, etc.) / based on expert polls;

2.3. Seasonality of demand for anted acid;

2.4. Advantages and disadvantages (including technological) anticoic acids compared to alternative chemicals used in industries that form demand.

3. The price situation of the anticoic acid market in 2011-2018. Price forecast until 2025

3.1. The dynamics of anti-antic acid prices in 2011-2018. Price forecast until 2025

3.2. Factors that determine the dynamics of prices. The share of logistics costs in the price of the implementation of the main players.

4. Competitive analysis of the sodium formation market in Russia in 2017-2018

GG.

4.1. The main players in the market of the form of sodium. Their competitive advantages and fractions in the market;

4.2. Forecast for the development of competition until 2025

Conclusion and conclusions in the anti -acid market

II. The market for potassium form

1. Analysis of the market for potassium formation in Russia in 2011-2018.

1.2. Analysis of export-import supplies of potassium formation according to manufacturers, by suppliers, at a price) in 2011-2018. The capacity of the market for potassium form (in tons and in rubles). The main importers and their shares (import development plans). The main world manufacturers (production volume, year of launch of installation, planned dates of modernization/overhaul);

1.3. The main trends and forecast of market development (optimistic,

pessimistic, basic) potassium form in Russia until 2025

2. Analysis of consumption and demand for potassium form in 2017-2018. Demand forecast until 2025

2.1. Demand for potassium form in 2017-2018 The current and forecast consumption of potassium forms for consumption areas and the largest consumers until 2025:

- manufacturers of reagents;

- manufacturers of drilling solutions;

- manufacturers of building mixtures and cement;

- manufacturers of refrigerants;

- Other consumers

(price, technical characteristics, regularity of supply, etc.) / based on expert polls;

2.4. The advantages and disadvantages (including technological) forms of potassium in comparison with alternative chemicals used in industries that form demand.

3. The price situation of the market for potassium form in 2011-2018. Price forecast until 2025

3.1. The dynamics of prices for potassium form in 2011-2018. Price forecast until 2025

3.2. Factors that determine the dynamics of prices. The share of logistics costs in the price of the implementation of the main players.

4. Conclusive analysis of the potassium market in Russia in 2017-2018.

4.3. Forecast for the development of competition until 2025

Conclusion and conclusions on the market of potassium form

III. Calcium formation market

1. Analysis of the market for the formation of calcium in Russia in 2011-2018.

1.2 Analysis of export-import supplies of the formation of calcium according to manufacturers, suppliers, at a price) in 2011-2018. Calcium market capacity (in tons and in rubles). The main importers and their shares (import development plans). The main world manufacturers (production volume, year of launch of installation, planned dates of modernization/overhaul);

pessimistic, basic) format of calcium in Russia until 2025

2. Analysis of consumption and demand for the format of calcium in 2017-2018. Demand forecast until 2025

- manufacturers of feed / feed additives;

2.2. Factors for making consumer decision on the purchase of calcium form (price, technical characteristics, regularity of supply, etc.) / based on expert polls;

2.3. Seasonality of demand for calcium format;

2.4. Advantages and disadvantages (including technological) of calcium forms in comparison with alternative chemicals used in industries that form demand.

3. The price situation of the market for the format of calcium in 2011-2018. Price forecast until 2025

2025

4.2. Forecast for the development of competition until 2025

IV. The market of the form of sodium

1. Analysis of the market for the formation of sodium in Russia in 2011-2018.

1.2. Analysis of export-import supplies of the formation of sodium according to manufacturers, suppliers, at a price) in 2011-2018. Calcium market capacity (in tons and in rubles). The main importers and their shares (import development plans). The main world manufacturers

(production volume, year of launch of installation, planned dates of modernization/overhaul);

Pessimistic, basic) sodium form in Russia until 2025

2. Analysis of consumption and demand for the formation of sodium in 2017-2018. Demand forecast until 2025

2.1. Demand for the format of sodium in 2017-2018 the current and forecast consumption of the formation of sodium in consumption areas and the largest consumers until 2025:

- manufacturers of reagents for skin dressing;

2.2. Factors for making consumer decision on the purchase of sodium form (price, technical characteristics, regularity of supply, etc.) / based on expert polls;

2.3. Seasonality of demand for the form of sodium;

2.4. Advantages and disadvantages (including technological) of sodium formation in comparison with alternative chemicals used in industries that form demand.

3. The pricing situation of the sodium formation market in 2011-2018. Price forecast until 2025

Conclusion and conclusions in the market of the form of sodium

V. The market of other salts of anticoic acid (in case of their presence in the market in commodity quantities).