1.1. Production

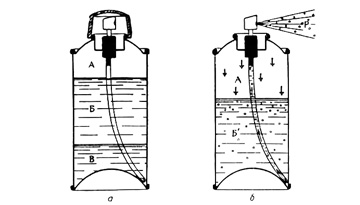

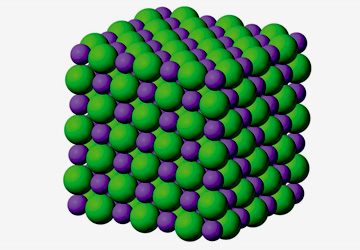

1.1.1. Producers of hydrogen in the Moscow and Moscow region. Breaking according to production methods. Savorization of the type of ownership. Breaking into three groups of cleanliness: less than N30, N35-N45, N50 and higher.

1.1.2. The volume of production (the nominal ability established by the production facility, effective annual production by the production facility after seasonality and the impacts of accessibility, identified new full projects). Breaking according to production methods. Breaking into groups of cleanliness.

1.1.3. Suppliers of hydrogen of the Moscow and Moscow region. Breaking into groups of cleanliness.

1.1.4. The volume of delivery to the Moscow and Moscow region from other areas: a complete annual influx, smashing through suppliers. Breaking into groups of cleanliness.

1.1.5. H2 Exw Prices (manufacturers): 2008, crisis exposure, future trends. Breaking into groups of cleanliness.

1.2. Hydrogen consumers

1.2.1. End users (sectors, statements, volumes, prices for end users, dividing into three cleanliness groups) by segments:

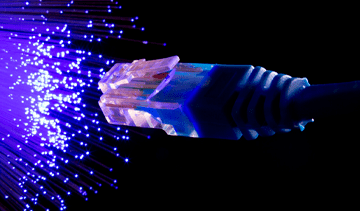

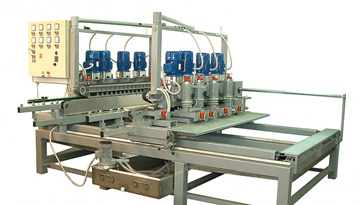

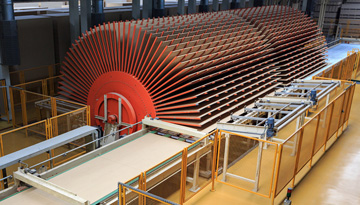

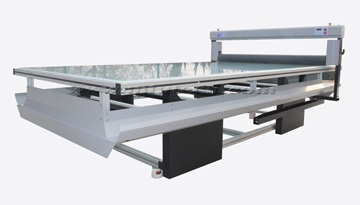

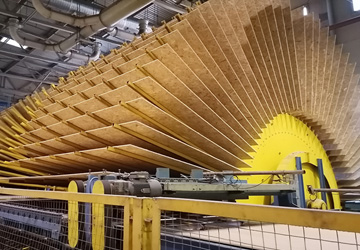

1.2.1.1. Glass, optical fiber, cement

1.2.1.2. Welding

1.2.1.3. Laboratories

1.2.1.4. Electronics

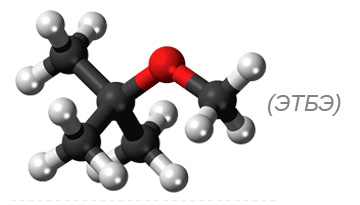

1.2.1.5. Hydrogenation of amines and fatty acids, production of plastics, polyester and nylon)

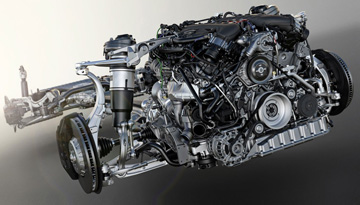

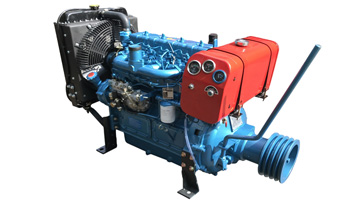

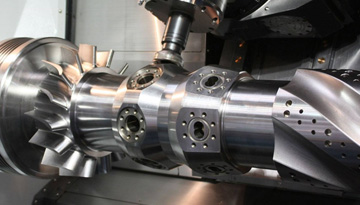

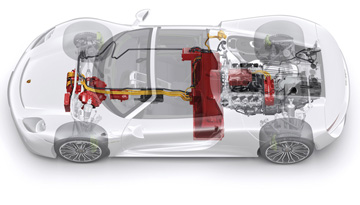

1.2.1.6. Metals industry (returning atmosphere for heat treatment)

1.2.1.7. Space

1.2.1.9. Other

1.2.2. Fillers: a description of a business model, a brief overview of the main fillers (volumes, vacation prices, a group of purity)

1.2.3. Dealers: a description of a business model, a brief overview of the main fillers (volumes, vacation prices, a group of purity)

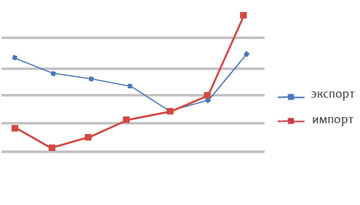

1.2.4. Import/Export: Are there any regular flow flows/hydrogen export exports

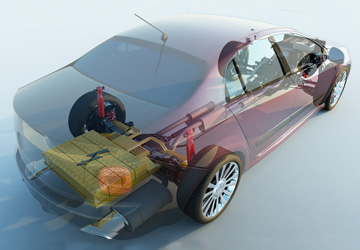

1.3. Logistics

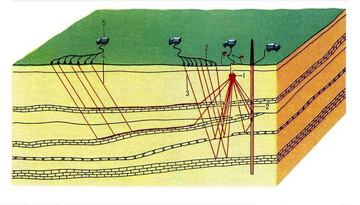

1.3.1. Railway transportation

1.3.1.1. transported volumes (total number and groups of purity),

1.3.1.2. Transport and storage suppliers (service indicators of transportation and storage companies),

1.3.1.4. Delivery conditions and requirements (necessary documentation, requirements to transport and tanks, transportation conditions, and so on)

1.3.2. Transportation by road

1.3.2.1. transported volumes (total number and groups of purity),

1.3.2.2. Transport and storage suppliers (service indicators of transportation and storage companies),

1.3.2.4. Delivery conditions and requirements (necessary documentation, requirements to transport and tanks, transportation conditions, and so on)

1.4. Distribution: A brief overview of hydrogen sales channels (volumes and number of players in each channel)

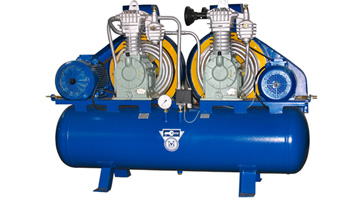

1.4.1. Pumping companies

1.4.2. Dealers

1.4.3. Trading intermediaries

1.4.4. End users

1.4.5. Other

2. competitors Ayra Likuaida

2.1. Local manufacturers H2: General strategy and business model

2.2. International gas manufacturers (Linde, air products): General strategy and business model

3. Long -term trends (10 years)

3.1. Market dynamics (requirement, delivery, balance, vacation prices, cleanliness groups)

3.2. Consumer dynamics

3.3. The dynamics of competitors

3.4. Trends in gas applications for segments