1. Section. General information about the electric motor market. Market structure throughout the market for 2015-2017. In natural and monetary terms. The share of Russian and foreign production for each type in natural and monetary terms:

- DC electric motors with a capacity of less than 37.5 W;

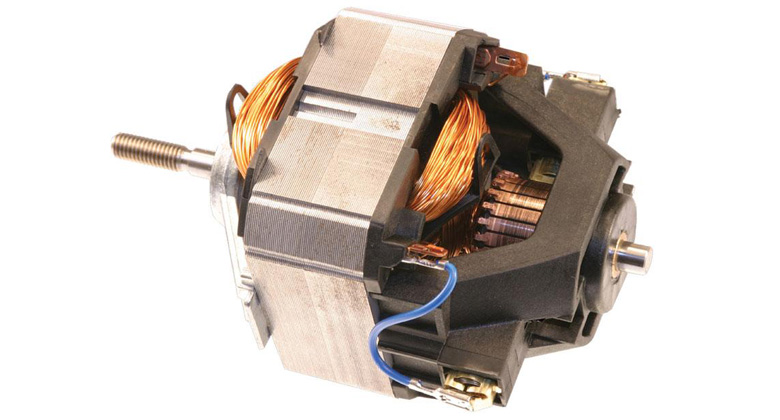

- AC electric motors universal with a capacity of more than 37.5 watts

- AC electric motors single -phase

- AC electric motors multiphase with a capacity of not more than 750 watts

- AC electric motors multiphase with a capacity of 750 W to 75 kW

- AC electric motors, multi -phase, output power of more than 75 kW

1.1. The dynamics and structure of Russian production of direct and alternating current and universal 2015-2017 engines. total and in the context by type of electric motors

1.1. The dynamics and structure of imports of direct and alternating current and universal 2015-2017 engines. total and in the context by type of electric motors

2. Section. Conjuncture of the UKD of UKD of the studied capacities

2.1. Russian production

2.1.1. Identification of Russian manufacturers of the UKD of the studied capacities (preliminary - Prompribor, Ostrovsky ZEM, Simferopol ETZ, Iolla, Leps and others, only no more than 10)

2.1.2. Collection of information for each company

- characteristics of the manufactured UKD (power, rotor diameter, stator length, etc.)

- Volume and dynamics of the produced VHF 2015-2017.

- level of loading capacities for the production of VHF

- structure and dynamics of the produced VHF in the context of capacities (80-180 kW, etc.)

- The main consuming segments

- volume and structure of export shipments of the produced VHF

2.2. Import

2.2.1. Identification of the import of OHF of the studied capacities 2015-2017.

2.2.2. The structure of VHF imports in the context of capacities

2.2.3. The structure of VHF imports in the context of manufacturers

3. Section. Conjuncture of consumption v

3.1. Assessment of the structure of consumption of VHF in the context of consuming segments

3.2. The formation of the consolidated base of all potential ultimate consumers of the VHF in the Russian market (name, specialization, scale of activity (revenue)) in total will be collected and provided by a base of several hundred companies

3.3. Information about the demand for VHF among the TOP-30 significant consumers in the Russian market. For each consumer, information will be collected and presented:

- the total volume of vding consumption per year

- Requirements for characteristics

- current suppliers

- willingness to change the supplier

3.4. The forecast for the development of consuming segments of 2023.

4. Section. Consolidated analytical report, forecasts of market development

4.1. The volume of the VHF market of the studied capacities 2015-2017.

4.2. The share of VHF consumption in the Russian market from the total volume of the electric motor market

4.3. The structure of the VHF market in the context of the capacities of 2015-2017.

4.4. The structure of the VHF market in the context of Russian/foreign manufacturers 2015-2017.

4.5. Prices for VHF participants in the Russian market

4.6. Positive and negative factors of entering a new manufacturer into the market

4.7. The forecast of market development as a whole and UKD for 2018-2023. (in natural and monetary terms).