The marketable boundaries of the study correspond to the YTO range:

- Wheel tractors for agriculture with a capacity of 18..220 hp (hereinafter referred to as "Wheel tractors")

- Caterpillar tractors for agriculture with a capacity of 40..140 hp (hereinafter referred to as "caterpillar tractors")

- Grain harvesters

- Corn harvesters

1. General information

1.1 Square of arable land in Russia

1.2 Distribution of arable land by cultures (grain, corn, potatoes, others)

1.3 Park of agricultural tractors and combines

1.4 State regulation of the market of agricultural machinery

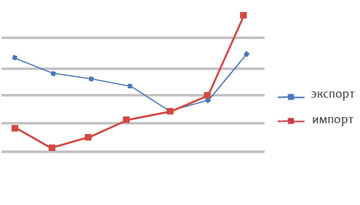

2. The Russian market of wheeled tractors

2.1 Production of wheeled tractors in Russia

2.1.1 The total production of wheeled tractors

2.1.2 Distribution of the production of wheeled tractors for the main manufacturers

2.1.3 Distribution of the production of wheel tractors by classes (capacities)

2.1.4 brands and characteristics of the most in demand in Russia of Russian -made wheeled tractors

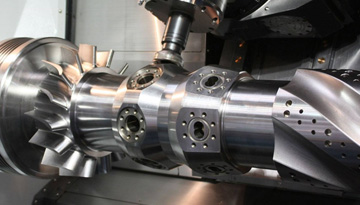

2.1.5 The volume of use of foreign components in the assembly of wheeled tractors in monetary terms for each assembly production, distribution by groups of products, examples of the most significant components

2.2 Import of wheeled tractors to Russia

2.2.1 The total volume of imports of wheeled tractors

2.2.2 Distribution of imports of wheeled tractors in the main manufacturers

2.2.3 Distribution of imports of wheeled tractors by classes (capacities)

2.2.4 brands and characteristics of the most in demand in Russia of the wheeled tractors of imported production

2.3 Export of wheeled tractors from Russia

2.3.1 General export of wheeled tractors from Russia

2.3.2 Distribution of exports of wheeled tractors by classes (capacities)

2.4 Price level for the most popular wheeled tractors in Russia

2.5 Project forecast for wheel tractors in Russia in 2020..2025

3. Russian caterpillar tractors

3.1 Production of caterpillar tractors in Russia

3.1.1 The total production of caterpillar tractors

3.1.2 Distribution of production tractors for the main manufacturers

3.1.3 Distribution of production tractors in classes (capacities)

3.1.4 brands and characteristics of the most popular caterpillar tractors of Russian production in Russia

3.1.5 The volume of use of foreign components in the assembly of caterpillar tractors in monetary terms for each assembly production, distribution by groups of products, examples of the most significant components

3.2 Import of caterpillar tractors to Russia

3.2.1 The total import of caterpillar tractors

3.2.2 Distribution of imports of tracked tractors in the main manufacturers

3.2.3 Distribution of imports of tracked tractors by classes (capacities)

3.2.4 brands and characteristics of the most in demand in Russia of caterpillar tractors of imported production

3.3 Export of caterpillar tractors from Russia

3.3.1 total export of tracked tractors from Russia

3.3.2 Distribution of export of caterpillar tractors by classes (capacities)

3.4 Price level for the most popular caterpillar tractors in Russia

3.5 demand for the demand for tracked tractors in Russia in 2020..2025

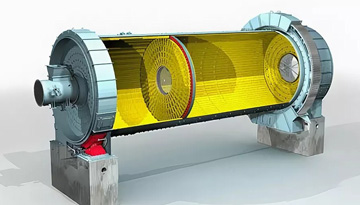

4. Russian market of grain harvesting combines

4.1 Production of grain harvesting combines in Russia

4.1.1 The total production of grain harvesting combines

4.1.2 Distribution of the production of grain harvesting combines according to the main manufacturers

4.1.3 Distribution of the production of grain harvesting combines by classes (capacities)

4.1.4 brands and characteristics of the most popular in Russia of Russian -made grain harvesters

4.1.

4.2 Import of grain harvesting combines to Russia

4.2.1 The total volume of imports of grain harvesting combines

4.2.2 Distribution of imports of grain harvesting combines according to the main manufacturers

4.2.3 Distribution of imports of grain harvesting combines by classes (power ranges)

4.2.4 brands and characteristics of the most popular grain -harvesting combines of imported production in Russia

4.3 Export of grain harvesting combines from Russia

4.3.1 The total export of grain harvesting combines from Russia

4.3.2 Distribution of export of grain harvesting combines by classes (capacities bands)

4.4 Price level for the most popular grain harvesters in Russia

4.5 Forecast for demand for grain harvesters in Russia in 2020..2025

5. The Russian market of corn harvesters

5.1 Production of corn harvesters in Russia

5.2 Import of corn harvesters to Russia

5.2.1 The total volume of imports of corn harvesters

5.2.2 Distribution of imports of corn harvesting combines according to the main manufacturers

5.2.3 Distribution of imports of corn harvesting combines by classes (capacities ranges)

5.2.4 brands and characteristics of the most popular in Russia corn harvesting combines of imported production

5.2.5 The volume of use of foreign components in the assembly of corn harvesting combines in monetary terms, distribution by groups of products, examples of the most significant components

5.3 Export of corn harvesters from Russia

5.3.1 The total export of corn harvesters from Russia

5.3.2 Distribution of export of corn harvesting combines by classes (capacities ranges)

5.4 The price level for the most popular corn harvesters in Russia

5.5 Forecast of demand for corn harvesters in Russia in 2020..2025

6. Conclusions

6.1 Forecast for the development of the market of studied tractors and combines

6.2 Assessment of the possible volume of production in Russia of YTO wheeled tractors

6.3 Comparison of the most popular models and products YTO

6.4 Recommendations for the promotion of YTO on the Russian market