Stage 1. Marketing research on the market of main locomotives of Russia and the CIS countries

1.1. Characteristics of the market for main locomotives of Russia and the CIS countries

The characteristics of the locomotive market (electric locomotives and diesel locomotives) include the following information:

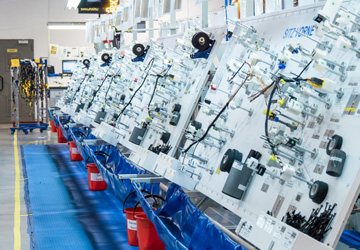

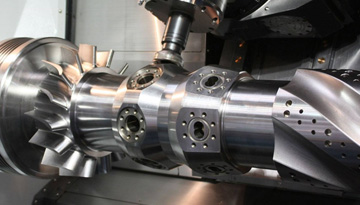

a) profiles of existing and potential manufacturers of main locomotives with production sites in Russia and the CIS countries, including: general information about the manufacturer; description of production capacities and their potential, the time of presence in the market; market share; property structure, subsidiaries and maternal companies; production volumes in 2010-2012, range of products and its cost; officially declared production plans until 2020; volumes and directions of supply.

b) the analysis of the intentions of manufacturers to create new production sites in Russia and the CIS countries or on the exit with the products produced abroad, to the Russian market and/or the CIS countries.

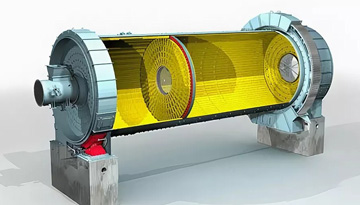

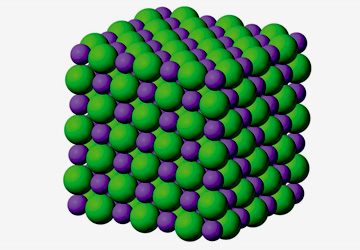

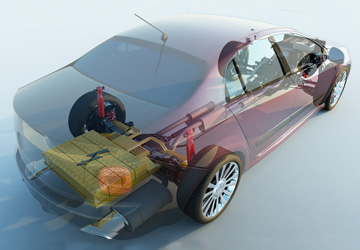

c) the characteristics of the model and age structure of the park of the main locomotives of the railway administrations and private owners (industrial enterprises, operators). Classification by series, type of rolling stock (alternating and direct current, dual systems), power range, type of traction electric drive and on the geographical principle (on the railways of Russia and the CIS countries).

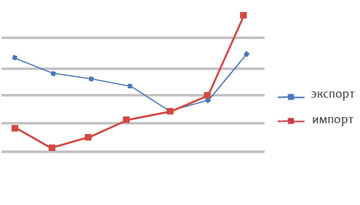

d) the characteristic of demand in the market of trunk locomotives for 2010-122. The structure of the rolling stock fleet owned by Russian Railways OJSC, the administrations of the Railways of the CIS countries and private companies: volume, purchases of rolling stock in 2010-2012; the cost of the purchased rolling stock; Description of the pricing system, criteria presented by consumers to new locomotives; The amount of rolling stock according to models, power, type of traction electric drive and release years.

e) conclusions on the current state of the market of trunk locomotives:

assessment of the level of competition in the market by type of rolling stock; assessment of competitive advantages and disadvantages of rolling stock manufacturers; Determination of the capacity of the market and the level of its saturation.

1.2. Study of the dynamics of the development of the market for main locomotives of Russia and the CIS countries

The study of the dynamics of the development of the market for main locomotives (electric locomotives and diesel locomotives) includes the following information:

a) diagnosis of changes in consumer preferences; Analysis of factors affecting the decision -making decision. Analysis of locomotive procurement plans until 2020.

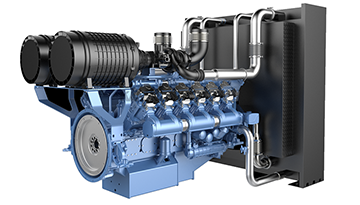

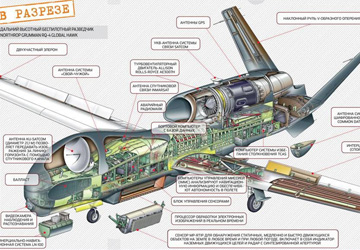

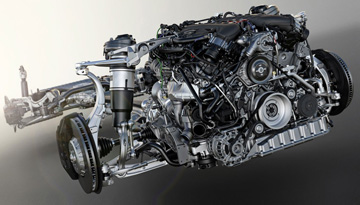

b) an expert assessment of the main trends and prospects for the development of the production of locomotives, including locomotives using liquefied natural gas: foreign experience, applicability in Russia.

c) analysis of the prospects for the development of the purchase of trunk locomotives by railway administrations and private owners until 2025 during the liberalization of the traction market. The formation of development scenarios for rapid liberalization, phased liberalization.

d) analysis of the compliance of world trends in locomotive construction and operating conditions of the current regulatory framework in Russia.

e) the description, analysis and forecast of the market for the modernization and the locomotive service until 2020. The global development trends of the locomotive service market and the description of the service system of foreign manufacturers. Assessment of the need for the development of a service network for a potential new player - a manufacturer of trunk locomotives.

f) the compilation of an appraisal forecast of changes in consumer preferences in the market of trunk locomotives. Analysis of the prospects for a change in demand based on the officially declared plans for purchasing locomotives, the needs to update existing locomotives by the railway of administrations and private owners.

1.3. Recommendations for choosing a market niche and product for entering the market of main locomotives (including gas -engine)

a) the identification and description of free niches in the market of trunk locomotives or niches, where demand is not enough satisfied. Analysis of conditions for expanding the presence of a new manufacturer in the market and capturing niches of competitors.

b) Development of recommendations for choosing a product for entering the market of a new manufacturer: determining the most appropriate parameters of such a product, the optimal price range, an expert assessment of the export potential of the product.

2. Stage 2. The concept of the creation and development of the locomotive operator.

2.1. Justification of the creation of a locomotive operator and its development.

The justification should include the following information:

a) a description of the market prerequisites and the regulatory framework for creating a private locomotive operator in Russia, based on the experience of liberalizing the market of freight wagons and the provisions of the structural reform of Russian railways. The existing tariff policy and description of routes, tariffs, work conditions and profitability of the work of private owners of locomotives in Russia (examples).

b) the offer of the most appropriate form and structure of the enterprise.

c) the substantiation and description of the stages of the creation and procedure for the functioning of the company, the most appropriate options for the development of the enterprise (the first stage is the allocation of shunting traction, the next stage -magistral thrust with the purchase of locomotives from its own production or other options).

d) an expert assessment of the most appropriate routes for operating locomotives of such a locomotive operator, potential customers, the required volume of locomotives until 2020 (indicating types and power series).

2.2. Economic assessment of the functioning of the locomotive operator.

a) the formation of scenarios for the development of transportation and economic activity of the locomotive operator until 2020, taking into account the liberalization of the traction market, changes in tariff policy, regulatory framework, and under the conditions of counteracting the liberalization of the traction market by Russian Railways.

c) the influence of the increase in the cost of the company until 2020 on the capitalization of the customer.

c) the rationale for the terms, conditions and feasibility of withdrawing the operator’s company on the RO, the appropriateness of the subsequent sale of the company or its share.

e) an expert assessment of the most appropriate rates and tariffs of the locomotive operator and their dynamics until 2020.

f) the creation of the economic model of the operator until 2020.