- Study and detailed comprehensive analysis of Russian suppliers of drilling equipment and suppliers of drilling services, service services, taking into account the analysis and description of the activities of key participants in the Russian market, including evaluating their production capacities, nomenclature of products, financial indicators, capabilities for import substitution in the context of equipment categories and electromaters used by the customer

- Analysis of the competitive environment of the market of drilling equipment, materials for drilling and completing wells in the Russian Federation sent to Russian companies. Analysis of manufacturers of drilling equipment and materials and suppliers of service services for creating profiles of the main Russian manufacturers, with an emphasis on offshore projects (in the Excel table according to the customer template), making analogues of foreign drilling equipment and materials, international brands according to the list of customer equipment with basic technical requirements.

- Analysis of pricing in the Russian market of oil and gas industry equipment and services for reconnaissance and ending wells.

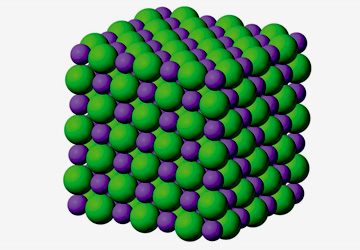

- Analysis of the possibilities of import substitution of foreign equipment installed at the customer’s facilities, Russian -made analogues, indicating critical inconsistencies.

- Conducting a comparative analysis of the conjuncture, trends and forecasts of the global oil and gas outbuildings market and equipment in the markets of Russia and China, trends in the development of business players (in terms of supply) in the market in the world and in the Russian Federation.

"Nonances"

Object and subject of research

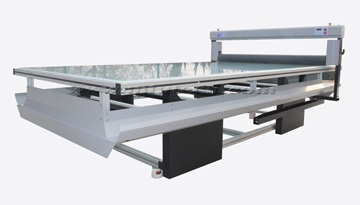

- Well -ending equipment

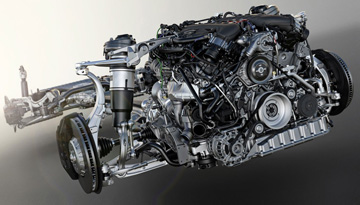

- Buggage drilling tool. (the basic technical requirements will be indicated)

- Drilling chisels and drunks. (the basic technical requirements will be indicated)

- Oil and gas outlet pipes. (the basic technical requirements will be indicated)

- Technological equipment of the casing

- Well equipment (the basic technical requirements will be indicated)

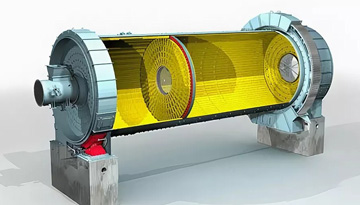

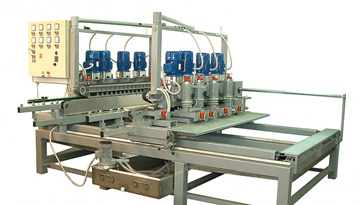

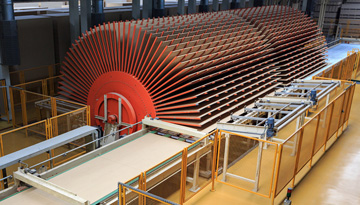

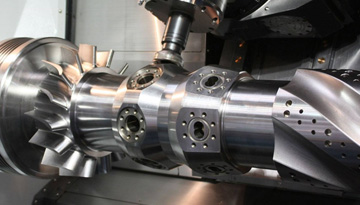

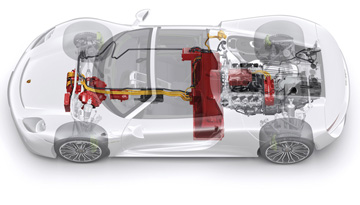

- Equipment of the drilling rig (the basic technical requirements will be indicated)

- Supporting and maintenance of shank suspensions. (the basic technical requirements will be indicated)

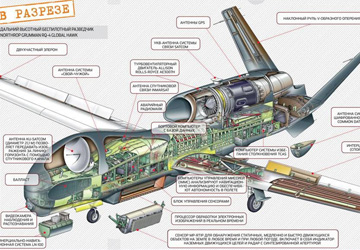

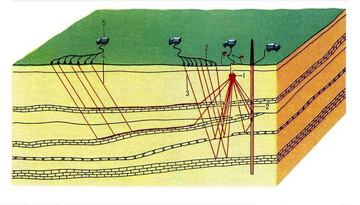

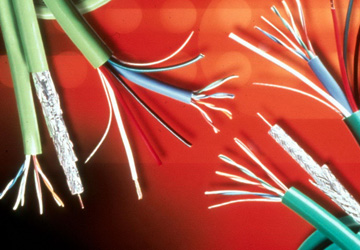

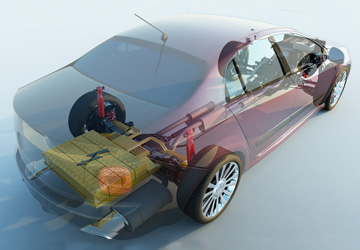

- Elocated-controlled drilling, carotage during drilling with sea platforms.

- Worm solutions and solutions for the ending of wells. (list of purchased)

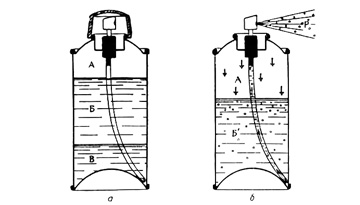

- Cementing and download.

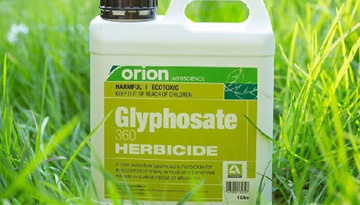

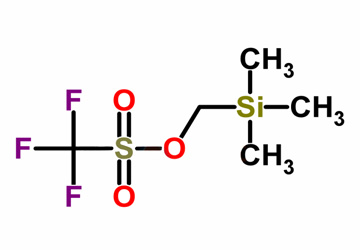

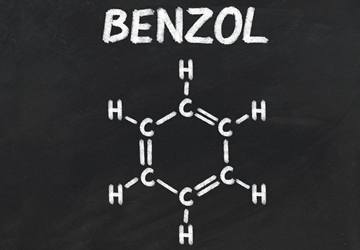

- Special chemicals for drilling and cementing. (list of purchased).

- Delivery of the proof, control of sand.

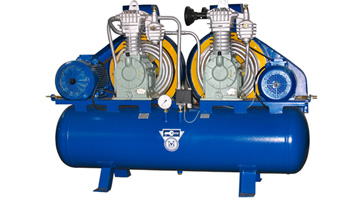

- Delivery and maintenance of upbringing equipment and air defense.

- Services on the Karotazhny cable/wire.

- Carotage by drilling solution (GTI)

- Fishing and milling tools, exiting systems of the casing, accompanying services (cutting of the side trunks and the supply of wedge wedges)

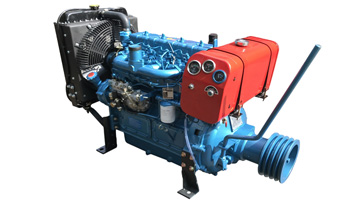

- Drilling service from sea platforms

Introduction.

Chapter 1. Analysis of the Russian oil and gas production services market, equipment and materials

1.1. Identification of all manufacturers present in the oil and gas service services market, equipment and materials in Russia for each market segment, 2014-2018 (with an emphasis on offshore projects):

- Equipment and well -ending services

- Buggage drilling tool

- Drilling and waking up

- Oil and gas outlet pipes

- Well equipment

- Drilling equipment equipment

- Shipping systems Supply Supply Systems

- Tilted-controlled drilling, carotage during drilling

- Drilling solutions and solutions for wells

- Cementing and download

- Special chemicals for drilling and cementing

- Delivery of Propant, Sand Control

- Supply and maintenance of upbringing equipment and air defense

- Services on Karotazhny cable/wire

- Carotage by drilling solution (GTI)

- Fishing and milling tools, exiting systems of the casing, accompanying services (cutting of the side trunks and the supply of wedge wedges)

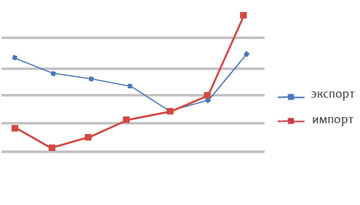

- Drilling service

1.2. Assessment of the volume and dynamics of the sale of oil and gas equipment, materials and services in Russia in 2014-2018. Based on the total supply of all identified manufacturers and forecast until 2023, in the context of the category of studied products and services based on specializations of companies

1.3. Market structure in the main categories of products and services based on specializations of companies

1.4. Assessment of current trends and prospects for the development of the oil and gas outbuildings market, equipment and materials in Russia in the context of the category of studied products and services

1.5. The evaluative forecast for the development of the Russian market until 2028 in the context of the category of studied products and services

1.6. Analysis and assessment of the competitive environment in the Russian market

- The production of oil and gas equipment in Russia 2014-2018. and forecast until 2023

- The volume of work on the drill service in Russia with the main players and projects

- The distribution of shares in the market, indicating the origin (Russian, localized, foreign) of drilling companies and manufacturers of drilling tools, drilling solutions, etc.

- TOP 15 leading Russian manufacturing companies for market segments (products line)

1.7. Experience in the provision of Russian companies for marine oil and gas projects

1.8. Factors for the development of the Russian oil and gas production services market and equipment at offshore projects

1.9. Profiles of Russian manufacturers (service providers):

- Name, TIN

- Brief description and direction of activity

- Review of manufactured products (assortment) (link to electronic catalog)

- Service overview (link to electronic catalog)

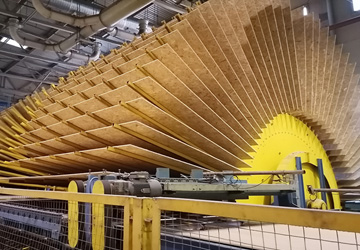

- production capacities of the enterprise (description of technological lines)

- financial indicators (including revenue) of the enterprise over the past 3 years

- Certification of equipment and services

- The main customers

- a list of projects in which the manufacturer took part

- subsidiaries and dependent companies

- founders/shareholders/final beneficiaries

- leaders

- Contact Information

1.10. The declared projects of new enterprises, as well as plans for existing enterprises to expand production until 2023

Chapter 2. Rating of the largest players in the market

2.1. The share of companies in the market of oil and gas industry equipment and services.

2.2. Rating of Russian market segments (products line):

- by the total market share

- by income level in each segment

- on the assortment of products and services

- By the number of participation in offshore projects

Chapter 3. Analysis of the global oil and gas service market, equipment and materials with an emphasis on offshore projects

3.1. Identification of world manufacturers of all the studied types of oil and gas services, equipment and materials in the countries of the Asia -Pacific region and other non -anction countries

3.2. The total supply of all the identified companies-manufacturers of oil and gas services, equipment and materials in the world market (if possible in the main categories)

3.3. Leaders (TOP 10 in terms of sales) manufacturers/suppliers in the studied regions in the context of specialization (category of products/services), the largest projects. Description of the activities of leaders and trends in the development of their business in Russia and other countries and regions of the world (tendencies of mergers and acquisitions, localization of production, etc.)

3.4. Trends, challenges, problems and prospects for the development of proposal in the oil and gas -sophisticated services market, equipment and materials in the context of the studied categories of products and services based on the study of the activities of identified companies

Chapter 4. Analysis of the readiness of the market for oil and gas -free services and equipment to satisfy the needs of Sakhalin Energy Investment Company LTD. with the prospect until 2023

4.1. Opportunities for import substitution of equipment under consideration, materials and drilling services (comparative analysis of the basic technical requirements for the customer with the capabilities of Russian manufacturers for each segment under consideration). Technical requirements are provided by the customer.

4.2. The willingness to put equipment, materials and drilling services by companies in other countries (China, etc. "Non -anctive" countries according to the specifications of the customer for those positions that Russian companies cannot provide.

Chapter 5. Analysis of pricing for oil and gas outfields of drilling service and related services and materials in Russia

5.1. Factors and features of pricing for the studied types of products/services

5.2. Projective prices for the studied types of products/services for the declared purchases of Russian oil and gas companies in 2014-2018.